-

2022-12-30

CBDT recently announced Common ITRs to simplify and streamline compliance as per the best practices. This step is perceived as a major breakthrough in the annual compliance framework.

Mr. Ameet Patel (Partner, Manohar Chowdhry & Associates) and Mr. M.V. Surendra Kalyan (Manager, Audit & Taxation) in their analytical piece on Common ITR discuss how ITRs have evolved from 3 to 7 variants over the decades. The authors take us through various aspects of the Common ITR viz., foreign remittances, pass through income, details of PE, GST reconciliation, among others. They also highlight the increase in complexity in disclosures pertaining to capital gains. They are of the view that the Common ITR is massive because the law itself is extremely complicated and manifests the Department's focus on collecting maximum data for developing insights through data analytics with the ultimate objective of unearthing undisclosed income and enhancing the revenue collection. The authors wholeheartedly welcome the Common ITR but with a hope that the Department will test the form and the utility thoroughly before rolling it out.

"Common ITR Forms – Back to Square One?"

Tax practitioners who have been in practice for more than 30 years would recollect those “good old days” when ITR forms where in printed form and were bought in hundreds from “Taxprint” in Mumbai (not sure where they were available in other cities). In those days, there were 3 ITR forms – Form No. 1, Form No. 2 and Form No. 3. As simple as that. And the best part was that the forms remained constant year after year. We did not have to worry about “how to fill up the new forms” because there were no new forms. In fact, most CA firms bought the blank ITR forms in bulk and used them over a couple of years.

Then, over the years, the number of ITR forms kept on increasing. The length of the ITRs also kept on increasing. More worrying was the highly complicated details that kept on being added to the ITR forms every year. Today, for AY 2022-23, we have a total of 7 forms – ITR 1 to ITR 7. Each form has its own complexity. In between the 1990s and 2022, the government experimented with several forms called “Saral” forms. That idea was still born because we have laws which are completely opposite of “saral” and to even think of having an ITR form that is saral when the laws are not saral is height of optimism. Naturally, those forms were ultimately phased out.

Now, on 1st November, 2022, the CBDT has issued a notification whose subject matter is “Draft common Income-tax Return-request for inputs from stakeholders and the general public- reg.”

So, now, coming a full circle, the CBDT has thought it appropriate to combine all the forms except ITR 7 into one common form. However, there is a catch. The current ITR-1 and ITR-4 will continue and the tax payer can opt for ITR-1 or ITR-4 (as the case may be) instead of the common form. Thus, assuming that the CBDT goes through with its plans, we will have 4 forms left. ITR-1, ITR-4, ITR-7 and the new common ITR.

In this article, we examine the new form that is proposed.

The main principle that seems to have been adopted while conceiving this form is that instead of designing and testing and rolling out different forms for different categories of tax payers, there should be one master form for all and depending on whatever is applicable to a particular tax payer, only the relevant fields would get activated and would need to be filled in by the tax payer. All other inapplicable fields would get deactivated for the tax payer.

Therefore, the first thing that stands out is that the proposed ITR is customized for the taxpayers with applicable schedules based on certain questions to be answered by the taxpayer. These questions are referred to as “wizard questions” in the notification! For those with a statistical bent of mind, the blank ITR form as notified for public comment runs into 74 pages (and this is without any data – once data is filled in, it is anybody’s guess, how long the form will be!).

The ITR is divided into several parts just as is the case with the existing forms. The basic information is to be filled in parts A to E. Out of these, Part E is the key to the entire form. It has 40 questions out of which 39 are to be answered in “Yes” or “No”. Question No. E.3 asks for the heads of income applicable to the tax payer. Depending on the answers provided in these 40 questions, the unnecessary or inapplicable parts of the ITR will get deactivated for the tax payer. For example, if a person does not have salary income then the fields where details of salary income are to be filled in will get deactivated. Then there are other parts of the ITR as under:

|

Schedule TI |

Schedule for computation of total income |

|

Schedule TTI |

Schedule for computation of tax |

|

Schedule BA |

Details of bank accounts |

|

Schedule TXP |

Schedule for the tax payments |

In the verification, in addition to what is currently mentioned in the existing forms, the following words have been added:

“and that the amount of total income and other particulars shown therein are truly stated”

A few important changes in the ITR are as under:

- Details of Tax Return Preparer (TRP) are no longer required to be filled up in the ITR. Readers would recollect that there is a concept of “TRP” who helps tax payers in preparing the return. It appears that this whole concept has failed and very few tax payers must be actually availing of the TRP services and that is why the details of TRP which are presently required to be filled in the ITRs are now removed from the proposed ITR.

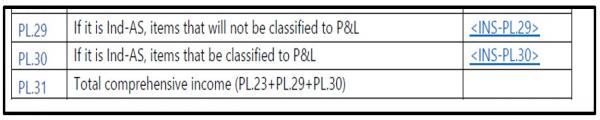

- A single P&L Account is incorporated rather than earlier method of two options of P&L i.e., for normal Companies and companies having applicability of IND AS. However, a table has been incorporated for giving the effect of IND AS adjustments:

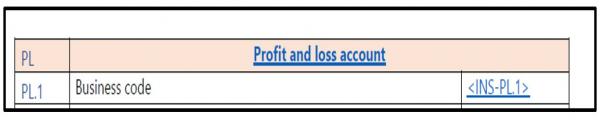

- Profit and loss schedules and Presumptive tax schedules of PGBP have a field of business code to be filled. Assessee get to classify their income from businesses in systematic manner with the business code in these schedules.

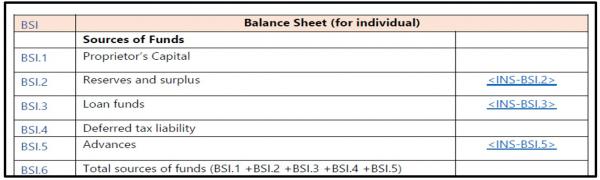

- Details of advances under balance sheet is added in individual balance sheet which was earlier not available:

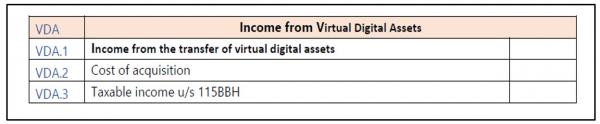

- A new schedule has been incorporated for information of Virtual Digital Assets (VDA). In term of sequence, this has been added after the PGBP schedules.

Interestingly, in the schedule for PGBP (at Item No. BP.46) as well as for Capital Gains (at Item No. CG.2 read with the instructions – INS-CG.2) both have a field for giving the figure of profit from VDA. At both places, there is cross reference to the VDS schedule. It therefore seems to indicate that the tax payer does have an option to decide whether buying and selling of VDA is a business or an investment activity. However, obviously, irrespective of the head of income under which such income is offered for tax, the special regime u/s 115BBH will apply and the profit will be computed as per the provisions of this section and taxed at 30%.

- A separate sub schedule is added under - Presumptive Income for each section of presumptive taxation. This requires the assessee to fill in details for each section of presumptive income offered allowing the income tax department to have greater data availability.

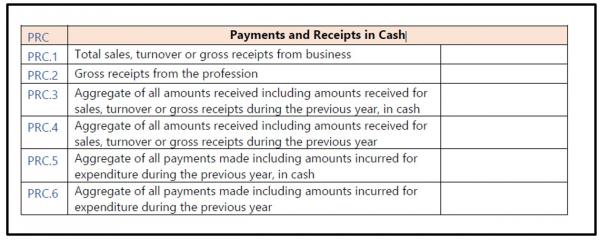

- A schedule of “Payments and Receipts in Cash” is added to disclose the details of total receipts and payments and out of that, the amounts paid or received in cash.

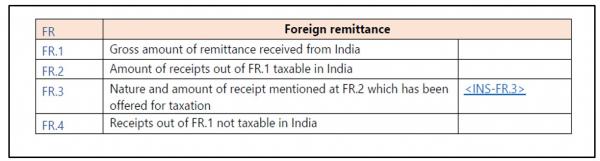

- A schedule for details of “Foreign Remittance” has been added:

It is not clear as to why the words used in FR.1 are “Gross amount of remittance received from India”. If the intention was to seek details of foreign remittances which a tax payer has received and whether the same is taxable in India or not and whether the taxpayer has offered that for tax in India or not, then the words to be used ought to have been “Gross amount of remittance received from outside India”.

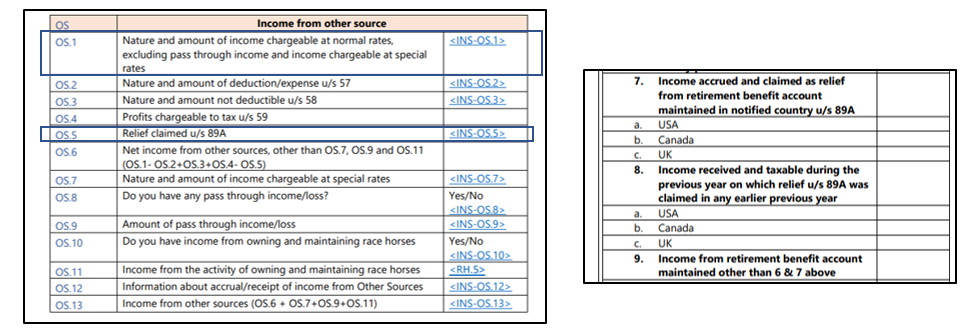

- A detailed note for Pass through income along with details of PAN is added in every head of income

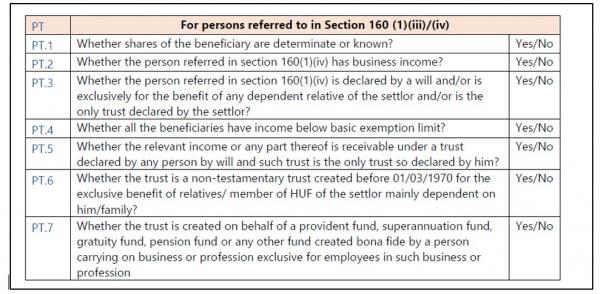

- A schedule of “For persons referred to in Section 160(1)(iii)/(iv)” is added to the return:

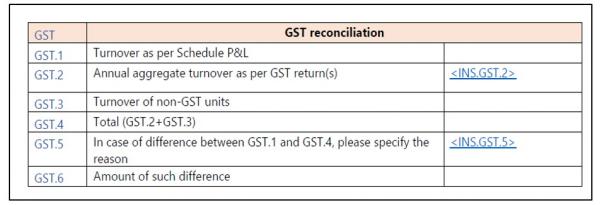

- In the existing ITR forms, the taxpayer is required to disclose the total turnover as per the GST returns. In the proposed ITR, a GST reconciliation table has been added. The assessee will now have to provide GST turnover Reconciliation along with reasons for differences.

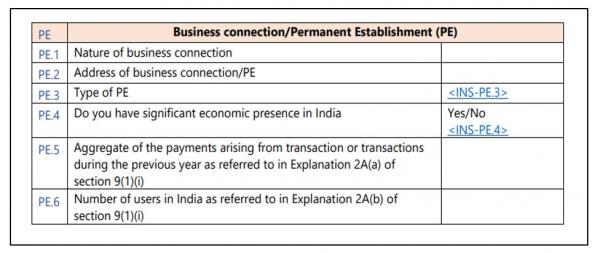

- The details of “PE” to be provided in the ITR are now increased

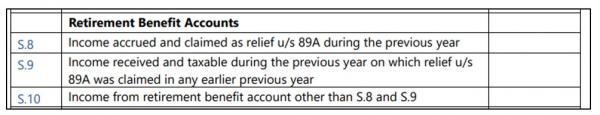

- Foreign Retirement Income is to be provided under income from salaries and income from other sources in two parts as under:

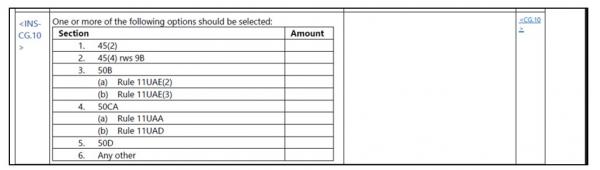

- The list of incomes under Capital Gains i.e., “Type of capital gain, other than pass through income” is more defined and has been developed as a list of 24 items as against a list of 5 items in the existing ITRs. This only highlights how complicated the entire scheme of taxation of capital gains has become with so many permutations and so many “if then” being brought into the Statute.

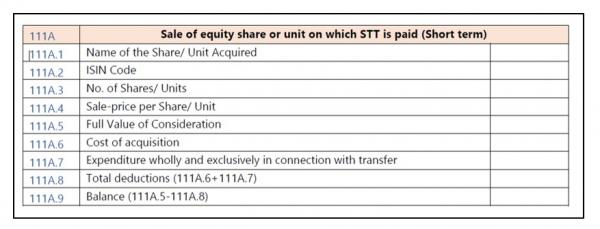

- A new schedule for income under section 111A “Sale of equity share or unit on which STT is paid (Short term)” is added:

- A disclosure of amount under specific column for “Section under which fair market value is being computed (other than section 50C) and amount thereof” is brought in as under:

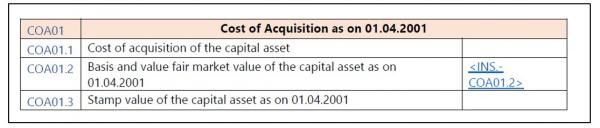

- In case of assets held by the taxpayer prior to 01/04/2001, a separate table of details (COA01) is to be filled in as under:

Providing the stamp duty value as on 01.04.2001 is an added burden on the taxpayer and it is not clear as to why this information is called for.

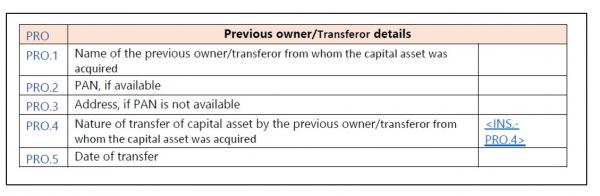

- In case of asset transferred under the modes mentioned in section 47, the following table containing details of previous owner is to be filled in:

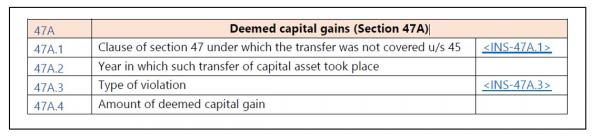

- In case of Deemed Capital Gain, details are to be provided as under:

Conclusion

With the proposal to bring in a common ITR form in place of multiple forms, the when has turned a full circle and we will go back to the 20th century when we had very few forms. In effect, we are back to square one! The critical difference is that in the past, the ITR forms were simple. Now, the form is massive and that is because the law has become extremely complicated. Also, the focus of the income-tax department is on collecting as much data as possible so that its highly active data analytics team can work on that data and provide them with valuable insights with the ultimate objective of unearthing hitherto undisclosed income and enhancing the revenue collection. We wholeheartedly welcome the concept of the common ITR form. We only hope that the tax department will test the form and the utility thoroughly before rolling it out. Past experience in such matters has been very bitter and tax payers and tax professionals have had to bear the brunt of half baked efforts which have resulted in extra ordinary stress and extension of due dates year after year. Let us all hope that the new ITR will bring smiles to the faces of the various stakeholders and not more stress.