Introduction

The digital economy in India is growing at a rapid pace at ten per cent per year, significantly faster than the global economy as a whole. Online advertising forms an integral part of the expeditious growth of the digital economy.

Considering this accelerated growth, it is necessary to address the challenges with regard to taxation of digital transactions. E-commerce companies like Facebook, Google and Yahoo are the beneficiaries of this increase in expenditure, with a major chunk of their revenue being generated from outside their country of residence.

Such companies did not have to pay any tax in India, neither were they subjected to any withholding taxes, since the performance for the requested services were not executed in India. The revenue from these services rendered cannot be attributed to the operations of the Indian entity and due to the lack of a PE in India, no tax is applicable on the said income. Most of these companies were avoiding income tax both in the country of source as well as country of residence.

Equalisation Levy

The Organisation for Economic Co-operation and Development (OECD) released its final report on the tax challenges of the digital economy (Action Report 1) under its Action Plan on Base Erosion and Profit Shifting (BEPS) which provided 3 different options for overcoming these challenges, and one of the options suggested is Equalisation Levy.

Equalisation levy is by its definition a levy to equalise the tax component of a resident e-commerce company as well as a non-resident e-commerce company.

The Finance minister has taken the OECD’s options into consideration and has proposed in the Union Budget that these companies would be brought inside the taxation circle with the introduction of a new equalisation levy (EL) scheme that has been brought in through Chapter VIII of Finance bill, 2016. Under this regime, tax is to be payable at the rate of 6% of the gross consideration received by a non-resident for specified services provided to a resident in India or to a non-resident having a permanent establishment in India. This levy will apply only on Business to Business (B2B) transactions and it extends to the whole of India except the state of Jammu &Kashmir.

This levy would be effective from the date that is to be appointed in the notification that will be issued in the Official Gazette by the Central Government.

Specified Services

“Specified services”, as mentioned in the Finance Bill means “online advertisement, any provision for digital advertising space or any other facility or service for the purpose of online advertisement and includes any other service as may be notified by the Central Government.”

Exemptions

The exemptions for this levy are:

1.If the non-resident providing the specified service has a permanent establishment in India and the specified service is effectively connected with such permanent establishment.

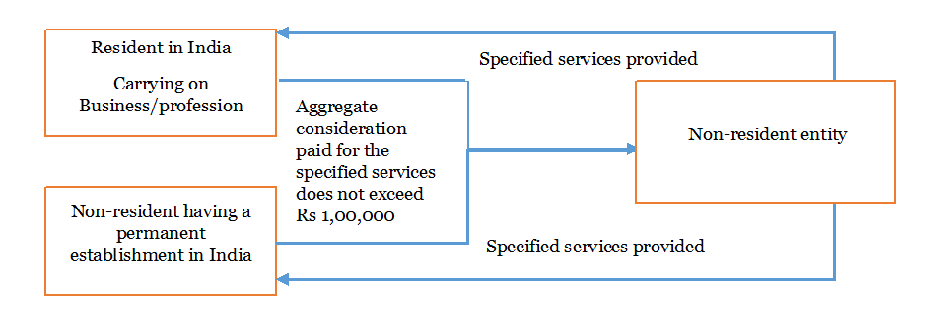

2. In order to reduce the burden of small players in the digital domain, an exemption is provided if the aggregate amount of consideration that is to be paid by a resident in India who is carrying on business or profession, or by a non-resident having a permanent establishment in India does not exceed one lakh rupees in any financial year and this payment is made towards the specified services provided by the non-resident entity.

3. Where the payment for the specified services is not for the purposes of carrying out business or profession.

Benefits to the payer

In Budget 2016, FM has proposed to amend Section 40 of the Income Tax Act, 1961 (IT Act)so as to allow the expenses as deductions on which such equalization levy is imposable (online advertisements) only for the year in which such levy has been paid to the government.

Benefits to the non-resident e-commerce Companies

For the foreign providers who will be in the receiving side of this levy, an amendment has been proposed in Section 10, adding a new Sub-section (50) to the IT Act, which ensures that the incomes on which such equalization levy has already been deducted and paid shall be considered exempt in India. Hence, the payment that is already made by the recipients of the specified services on the behalf of the non-resident e-commerce companies could be claimed by the non-resident e-commerce companies through filing the Income Tax Return.

Collection of Levy

The obligation to deduct and deposit the tax to the Central government lies with the resident payers in India or non-resident payers having a permanent establishment in India.

Such amount collected shall be paid by every assessee to the Central Government by the seventh day of the month immediately following the said calendar month.

Furnishing of Returns

Every resident shall, within the prescribed time after the end of each financial year, prepare and submit to CBDT, a statement in such form, as may be prescribed, in respect of all specified services received during the financial year. These statements can be revised in case of any omissions or wrong particulars, at any time before the expiry of 2 years from the end of the financial year in which the specified services were provided if they are filed within the prescribed time.

For the purpose of processing the statements, CBDT may make a scheme for centralised processing of such statements to instantly determine the tax payable by, or the refund due to, the assessee.

Interest

Every assessee, who fails to pay the equalisation levy or any part thereof to the Central Government within the prescribed period, shall pay simple interest at the rate of one per cent of such levy for every month or part of a month by which such payment of the tax or any part thereof is delayed.

Penalty

1.Any assessee who fails to deduct the whole or any part of the equalisation levy, a penalty equal to the amount of equalisation levy have to be paid to the Central Government;

2. In case any assessee, having deducted the equalisation levy, fails to pay such levy to the Central Government shall be liable to pay a penalty of one thousand rupees for every day during which the failure continues, provided that the penalty shall not exceed the amount of equalisation levy that he failed to pay;

3. Any assessee who fails to furnish the statement within the time prescribed, shall be liable to pay a penalty of one hundred rupees for each day during which the failure continues.

No penalty shall be imposable if the assessee proves to satisfaction of the Assessing Officer that there was reasonable cause for the said failure and the Assessing Officer is satisfied with the same. Further, no order imposing a penalty shall be made unless the assessee has been given a reasonable opportunity of being heard.

Conclusion

With introduction of this levy, India joins the league of various other countries with similar levies for providing equal opportunities to the domestic businesses. In addition, avoidance of double taxation of such transactions has been secured by creating a specific Income tax exemption for specified services chargeable to this levy. However, Equalisation Levy has not been introduced by amending the IT Act (but through a Chapter in the Finance Bill 2016), hence the ability of a non-resident to claim credit in its jurisdiction may be doubtful as even under the Tax Avoidance Agreements.

(With inputs from Jithin Jacob Mathew, Associate, KPSN Consulting LLP)