-

2017-06-13

Introduction

In order to tackle the challenges in the digital economy, the provisions of equalization levy were brought in by Chapter VIII of Finance Act 2016, in line with BEPS Action Plan 1. In pursuance of the same, the Central Board of Direct Taxes ('CBDT') made equalisation levy ('the levy') effective from 1 June 2016 (vide Notification no 38 of 2016 dated 27th May 2016). As per provisions of the law, the statement of specified transactions for the levy is to be filed before the tax authority on or before 30 June, 2017 for the financial year ('FY') ended 31 March 2017.

Since one FY is already over and the collection figures for the FY are available, this is the time to review the efficacy of the provisions of equalisation levy.

During the period 1 June 2016 to 31 March 2017, equalisation levy has contributed a meagre amount of Rs. 316.6 Crores to the exchequer, which is a mere 0.000186% of the gross tax revenue of the government of India.

Out of total collection of levy amounting to Rs. 316.6 Crores, two-thirds is contributed by the Bangalore region (Rs. 221.1 Crores) followed by the Mumbai and Delhi regions at Rs. 49.4 Crores and Rs. 28.9 Crores respectively. Share of aforesaid regions contribute to 91.7% of the total collection of the levy. The collections seem to be very low compared to the interest generated before introducing equalisation levy to tackle challenges in digital economy following BEPS Action Plan 1.

The above mentioned numbers also raise concerns on whether the levy has been implemented in the manner intended. Amongst the various reasons attributable to the very small collections could be lack of awareness about the new law in, smaller cities.

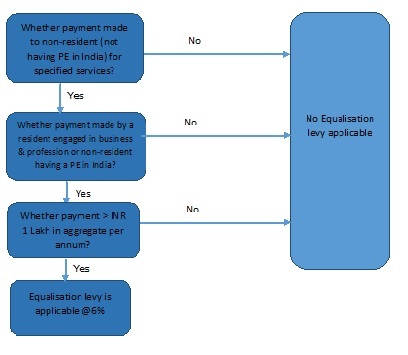

Another major issue with regard to equalisation levy is the ensuing compliance. An outline summarizing applicability of the levy, is as per below:

Once it is found that provisions of the levy are applicable, the points of compliance would be as below:

|

Sr No |

Particulars |

Compliances |

|

1 |

Point of applicability |

Chapter VIII of Finance Act, necessitates deduction of equalization levy on any amount paid or payable for the specified service to the non-resident. A reference could be made to the provisions of withholding tax which state that tax is deductible on payment or credit, whichever is earlier. Therefore, the intent of Chapter VIII could be said to mean that payer is liable to deduct equalization levy at the time of actual payment or when the obligation to pay arises, whichever is earlier. |

|

2 |

Payment of equalization levy |

Payment to be made by seventh of the month immediately following the relevant calendar month vide Challan No./ITNS 285 |

|

3 |

Statement of specified services |

First statement of specified services, to be filed in Form No.1, in respect of equalisation levy for the period 1 June 2016 to 31 March 2017 is due on or before 30 June 2017. The form has to be duly verified and furnished by the assessee: (i) Electronically under digital signature certificate or (ii) Electronically through Electronic verification code. Further, belated / revised statement can be filed within two years from the end of the financial year in which the specified services are provided. Failure to furnish Form No. 1 by 30th of June or within time specified in the notice (if any issued by the assessing officer) could attract a penalty of one hundred rupees for each day during which the failure continues. |

|

4 |

Consequences of default |

· Any default in deduction or payment of equalization levy would attract disallowance under section 40(a)(ib) of the Income-tax Act, 1961 (‘the Act.) In the Income-tax return (‘ITR’) forms notified for AY 2017-18, a new column has been inserted under ‘Part A-OI’ to mention such disallowance under section 40(a)(ib).

· There would also be interest and penal consequences as prescribed, if the levy is not deducted / paid / not paid within time. |

Ambiguities prevail

In addition to the meagre collection of the levy, there still exist certain ambiguities in respect of the levy itself. We have briefly touched upon some of the aspects:

1) Gamut of online services

The committee on taxation of e-commerce as constituted by the CBDT, had outlined a precise definition of specified services to be covered under the ambit of equalization levy. However, chapter VIII of Finance Act, 2016 provides only definition of online and specified services, which are wide and could cover a host of services under its ambit. This leaves the subject of specified services open for litigation as services have not been expressly mentioned under Chapter VIII of Finance Act, 2016.

Further, the terms, 'online advertising', 'provision of digital advertising space' and 'any other facility or service for the purpose of online advertisement' have not been defined in Chapter VIII. As per Clause 161(j) of Chapter VIII, the words and expressions used in Chapter VIII not defined therein and defined in Income-tax Act or Rules, shall have the same meaning as assigned in the Act or Rules. However, the aforesaid terms have been defined in the Act or Rules. Therefore, these terms will have to be considered as in their commercial parlance which could be a subject matter of debate.

2) Online market place

A question may arise whether online marketplace could amount to online advertising or provision of digital advertising space. One could argue that main income stream of the online marketplace provider is derived from providing a platform to facilitate online trading of goods. The online sales catalog being hosted on the website of the marketplace provider is incidental to the payment for the services. A view may be taken that the payment is not for online advertising or provision of digital advertising space. However, if hosting the vendors catalog on the website is also an essential part of the services rendered and provides images and other details, it may result in online advertising. One could find support in the report issued by the committee wherein Appendix 2 specifically mentions that, sellers or buyers selling tangible goods by using internet, will not be affected by equalization levy. The levy is not necessarily chargeable for all e-commerce transactions.

However, tax authorities may take a view that the service fee charged by digital market places like Amazon, Alibaba etc. from various brands include component for brand promotion of their products on the marketplace and hence the same is liable to equalization levy. Certain products, which are only sold online and not off-the-shelf could be said to have a large component of brand promotion embedded in the service fees paid to online market places.

3) Paid articles/ reviews /write-ups

Another avenue which could be subject matter of applicability of equalization levy, is paid articles / reviews / write-ups etc written with an agenda to promote oneself / company / brand etc. One can argue that paying for posting of an article on the website amounts to booking of digital space being expressly covered under specified services and would consequently attract equalization levy.

4) Role of intermediaries

Equalization levy applies to consideration received or receivable for specified services. It does not state that the levy would apply only if the payment is made to the primary service provider. Hence, equalization levy would be equally applicable in respect of specified services rendered by / rendered to intermediaries such as ad agencies etc. However, by keeping it out of purview of income-tax, the government has ensured that the Double Tax Avoidance Agreement ('DTAA') provisions would not apply and the tax payer will have to pay equalization levy regardless of the provisions of the DTAA, which country the recipient belongs to.

5) Foreign tax credit

Equalisation levy is an alternate to corporate tax for non-residents who do not have permanent establishment in India and have revenue from online services. However, no foreign tax credit is allowed in respect of the same as indicated by representatives of revenue department while speaking on public forums at various occasions.

Concluding remarks

Even though the Committee in its report suggested equalisation levy on many services (like online advertising; digital advertising space; online news; download online music, movies, games etc.), as of now it remains an open issue.

However, section 164(i) of Chapter VIII inter-alia provides that specified services include any other service as may be notified by the Central Government in this context. Though till date, no other service has yet been notified using this clause, it leaves the field open for the CBDT to widen the scope of services and the rate of equalisation levy.

Unlike the government's ease of doing business, undertaking compliance of the levy is an increased burden on tax payers. One of the possible views is that, it would have been convenient for tax payers if a small section could have been added to the return of income itself to report specified services. However, it appears that it has been a conscious effort by the government to not cover the levy under the Act and bring it under a separate law so that the levy is not covered by DTAAs.

Since the cumbersome process of compliance is involved, it is really worthwhile to evaluate whether for such a small collection there should be a separate law in existence which falls neither under the Act nor under the Goods and Services Tax.