-

2021-06-01

Issue No. 233 / June 1st, 2021

Dear Professionals,

“Taxsutra Database”, a true Income-tax research tool, is an archive of over 112090+ Income Tax Rulings reported across ITR, CTR, Taxman, DTR, ITD, TTJ, and ITR (Trib) and also includes recent ‘unreported handpicked rulings of SC, HC & ITAT’. It is a completely integrated service with the following features:

- Comprehensive coverage of all latest cases powered by an advanced search engine to provide a seamless user experience;

- Effective search results supported by active filters around Court Level, Location, Case Numbers and Citation;

- Enhanced search feature, using the Unique Bulls Eye Application, by including "Exact words", "Any of these", "none of these" options.

- Judicial “forward & backward reference”

We are glad to present to you the 233rd edition of ‘Taxsutra Database Bulletin’, where we keep you updated with current trends in the tax arena!

***********************

Expert Column

Tax Residency is one of main decisive factors for establishing the category of taxpayer and devising nexus with a country’s tax laws.Globally, the residential status of a person is a key factor in determining his or her taxability in a particular country which is different from citizenship. In India, Tax residency is determined u/s 6 of the Income-tax Act which until the amendment brought in by Finance Act, 2020 did not consider citizenship to be a determining factor/ condition. Indian Government introduced certain major amendments in Sec. 6 as anti-avoidance provisions that largely base its premise of ‘citizenship’ rather than ‘number of days of stay in India’.

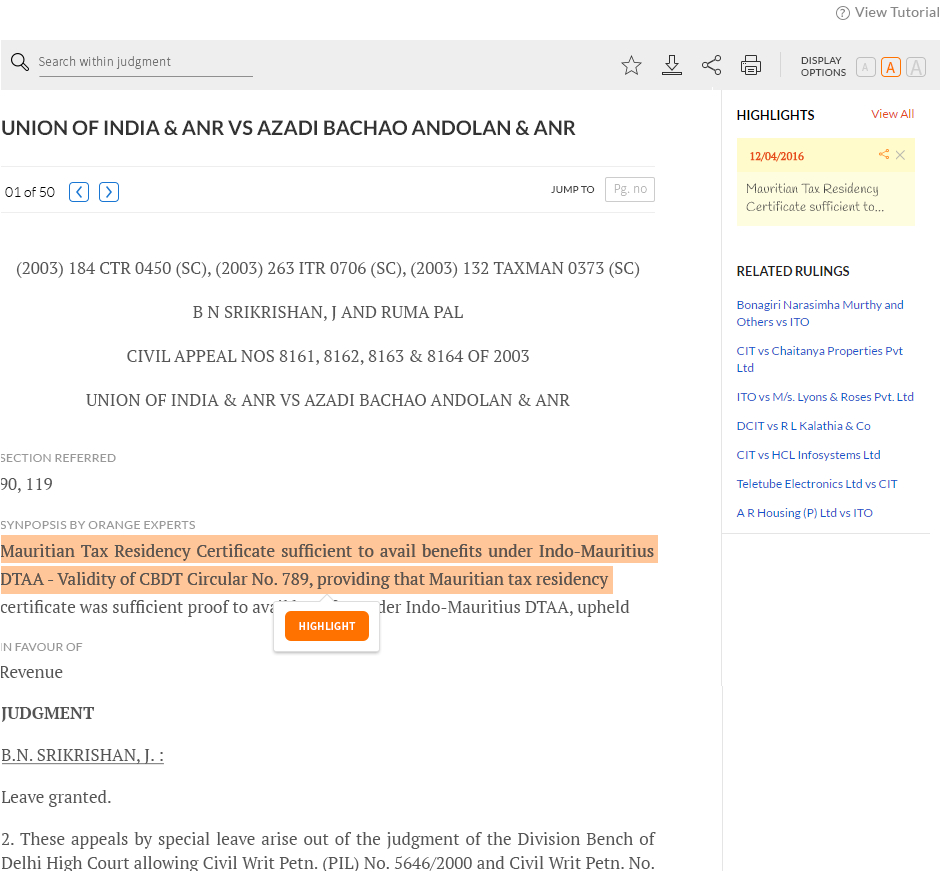

Against this backdrop, CA Parul Aggarwal elucidates on the amendments and its likely impact on the stakeholders particularly the NRI community as well as the ordinary residents in India. The author explains the concept of deemed residency introduced by the Finance Act, 2020 through insertion of new clause (1A) in Section 6. The author opines “In essence, there are many Indian citizens who become NRIs by taking the tax residency certificate of a tax haven. Such people not only avoid paying taxes in such tax haven (i.e. stateless person) due to the NIL tax rate in such jurisdictions, but also continue to stay in India for 6 months and enjoy the NRI status, thus taking benefit of all concessional tax rates and exemptions available to an NRI as perIndian tax laws”. Further, the author also analyses the amendments from a tax treaty perspective.

Against this backdrop, CA Parul Aggarwal elucidates on the amendments and its likely impact on the stakeholders particularly the NRI community as well as the ordinary residents in India. The author explains the concept of deemed residency introduced by the Finance Act, 2020 through insertion of new clause (1A) in Section 6. The author opines “In essence, there are many Indian citizens who become NRIs by taking the tax residency certificate of a tax haven. Such people not only avoid paying taxes in such tax haven (i.e. stateless person) due to the NIL tax rate in such jurisdictions, but also continue to stay in India for 6 months and enjoy the NRI status, thus taking benefit of all concessional tax rates and exemptions available to an NRI as perIndian tax laws”. Further, the author also analyses the amendments from a tax treaty perspective.

***********************

Key Takeaways from Handpicked Rulings

1) HC: Commissioner order rejecting condonation for belated return, 'highly pedantic'; Revenue to consider justice-oriented approach. HC allows assessee’s writ, sets aside Pr CIT order dismissing assessee’s application u/s 119(2) with respect to condonation of delay; Rejects revenue submission that ignorance of law, cannot be a ground for condoning the delay in filing the return. Terms Pr CIT order as ‘highly pedantic approach’, department ought to have............. Click here to read and download HC Order

2) ITAT: CIT(E) cannot reject application u/s 12AA for non payment of taxes on the donations / voluntary contributions received; Holds that the amount of taxes paid/ payable by the trust is to be determined at the stage of assessment proceedings and not at the time of granting registration u/s 12AA by CIT(E)...................Click here to read and download ITAT Order

3) HC: Disposes writ considering grievance addressed in CBDT’s subsequent Circular No. 10/2021 clarifying on extended limited for filing appeals before CIT(A) ..........Click here to read and download HC Order

4) ITAT: Confession of undisclosed income during the survey and statements recorded on the basis of receipts cannot be alleged as not based upon credible evidence – ITAT rules in favour of Revenue, holds that statements recorded by the survey team based on credible evidence without any retraction by the assessee has to be accepted...............Click here to read and download ITAT Order

5) ITAT : Any material collected or any statement recorded at the back of the assessee cannot be read in evidence against the assessee, unless the same is confronted to the assessee - ITAT allows assessee’s appeal, deletes addition on account of purchase of property; Holds that statement recorded u/s 131 of Shri Picheswar Gadde (assessee’s husband) and Shri Rakesh Sejwal (Manager) that certain portion of the transaction of a sale of property was made in cash, are not relevant; AO has referred to statement of Shri Rakesh Sejwal who was assigned various works with reference to transactions of different properties who have confirmed...............Click here to read and download ITAT Order

***********************

Lot's more at Taxsutra Database

Access all “Taxsutra Database Newsletters”, in case you have missed any!

Access latest News....and more!

-----------------------------------------------------------------

Ahuja-Gupta's 10 Superhit Direct-Tax Titles!!

Grab Tax Gurus Dr. Girish Ahuja and Dr. Ravi Gupta's bunch of 10 Superhit Direct-Tax e-books at just

Rs. 5,999!!! This pack includes following titles:

-

Income Tax Act - 10th Edition

2. Income Tax Rules - 10th Edition

3. Direct Taxes Ready Reckoner - 22nd Edition

4. Income Tax Mini Ready Reckoner - 24th Edition

5. Direct Taxes - Law & Practice -13th Edition

6. Taxation of Salaried Persons, Individuals & HUFs - 17th Edition

7. Taxation of Capital Gains -18th Edition

8. Guide To Tax Deduction At Source - 18th Edition

9. Concise Commentary on Income Tax (Expected to be released by end of July 2021)

10.Issues in Income tax (Expected to be released by August 2021)

You will immediately get access to a personally licensed e-copies of title no. 1 to title no. 8. E-copies of the rest of the 2 titles will be allocated to you as soon as those are released.

These are E-Book and will be made available to you on Taxsutra Reservoir under My Library

With a personally licensed Digital E book copy you can:

- Enjoy a great reading experience 24 X 7 on anydevice of your choice offering complete mobility

- Highlight sections of the Report, create notes and bookmarks, revisit their notes

- Seamlessly move from one section of the Report through another via a well-defined index of contents

Copyright © TAXSUTRA. All Rights Reserved