-

2018-01-09

Shell companies have been the focus of financial investigations and enforcement activities in recent times. Both Financial Intelligence Unit (FIU) and Serious Fraud Investigation Office (SFIO) have prepared lists of suspected shell companies. Few months back, SEBI had banned trading of 331 listed companies suspected to be shell companies. Against a background of crackdown on shell companies by regulatory agencies, it is apt for forensic auditors to identify and report possible transactions of their subject concerns with shell companies.

Theoretically, any company that does not have any active business operations or significant assets in their possession are called shell companies. Hence, even a holding company of a group or an intermediate paper company in a corporate structure also come under the definition of shell companies. These companies are not of interest to investigators; shell companies that are set up to provide accommodation entries or for layering of transactions are of interest to investigators. Such shell companies – that are created with a purpose of abusing fiscal laws – can be referred to as ‘shell companies for tax abuse’.

Some attributes of this class of shell companies are as under:

(a) Phony directors and phony addresses

Shell companies incorporated for tax abuse purpose are handled by accommodation entry operators. These entry operators are typically qualified accountants and usually do not run the companies in their name. They have to run dozens of shell companies. Cash is deposited in one company’s bank account and thereafter the funds are sent by RTGS to layers of companies. When this is done, it becomes almost impossible for an investigator to unravel layer after layer to reach at the source of cash deposit.

In order to manage this layering activity, entry operators need to operate many companies. They incorporate 20-50 (sometimes more) companies in a single address. The address given is usually a non-descript location and no real business runs from such an address.

Similarly, the directors are usually name-lenders without any real corporate background. Each director is director in numerous companies. On physical verification, either the directors are not traceable or found to be benamidars. Their identity is bought by the entry operator at a cheap price for KYC compliance.

As an illustration, the case of M/s. Anubhav Construction Pvt Ltd is taken. This company is part of a database of Kolkata-based shell companies prepared by Dhruv Purari Singh and publicly accessible. Upon doing a cursory analysis on Zaubacorp website, it is seen that a director of this company are directors in the following companies:

Figure 1 To be noted that this is only for demonstration purpose. The author does not derive any conclusion about any of these companies displayed in Zaubacorp database

Some company is into real estate, some into trading, some into jewellery business, some into auto business, some into housing finance, while some provide consultancies. Such diversified activities are common to large business groups such as Reliance and Tata. But are the companies with such diversified and colourful name actually doing any business? While we cannot jump to a conclusion without studying their Balance Sheet and P&L statements, this pattern is symptomatic.

(b) Incorporation in a bunch

In some cases, it is seen that incorporation of shell companies is done through ROC in bulk. The entry operator needs lots of companies in order to provide accommodation entries. For business convenience, he applies to ROC in bulk for multiple companies, and many companies with similar directors and similar addresses get incorporated on same day. The entry operator finds it convenient to apply for companies in bulk and get incorporation documents in bulk.

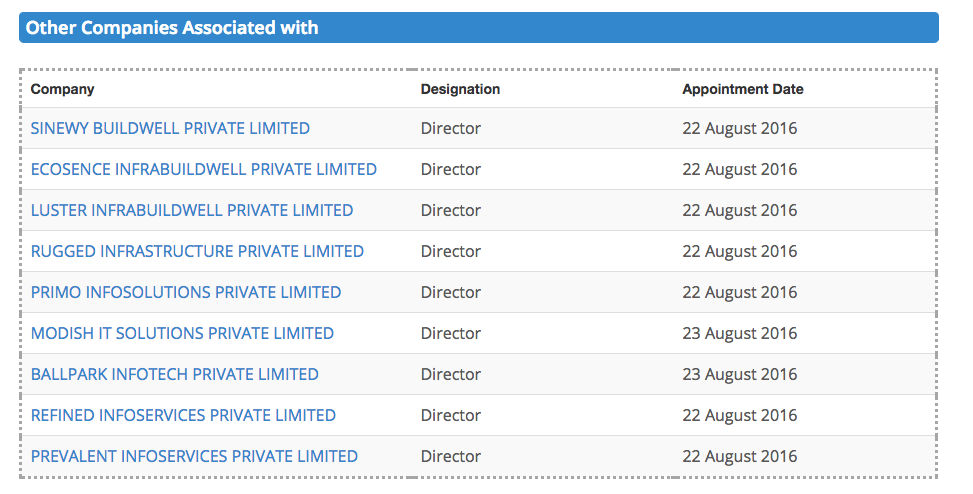

On browsing through Zaubacorp, it is seen that one individual is director of the following companies which were all incorporated on 22.08.2016 and 23.08.2016:

Figure 2 To be noted that this is only for demonstration purpose. The author does not derive any conclusion about any of these companies displayed in Zaubacorp database

All of the above companies have been incorporated on 22.08.2016 or 23.08.2016. They have the same directors and same address. While a user cannot jump to a conclusion based on this pattern, such pattern do raise suspicions.

(c) Unclear beneficial ownership or benami ownership

While directors are name lenders, beneficial ownership of most shell companies is not clear. Usually, one shell company’s shares are held by few other shell companies (layer ‘A’). When you go to the next layer and analyse the shareholding of layer A, you find that their shares are held by yet other shell companies (layer ‘B’). They may all have different directors but are run by the same entry operator. This modus – wherein the beneficial ownership is not clear – is typical of Kolkata-based shell companies.

Of late, it is seen that Delhi-based entry operators do not bother with such complex strategy. They simply make a lumpen individual with a background of poverty the benami shareholder.

Some lawyers are of the opinion that because of this feature, all kinds of shell companies come under the purview of the recently enacted Benami Transactions (Prohibition) Act.

(d) Curious back-to-back entries in bank account

Back-to-back entries in bank accounts always raise suspicion about the company being a shell company. High value funds come by RTGS and same funds are transferred out in the same day. Sometimes this is done to create multiple layers of transactions so as to obscure the source of funds (same funds move through 15-20 different companies’ bank accounts in a single day). A simplistic illustration of this would be that X gives cash to an entry operator. The entry operator deposits the cash in a bank account of one company. Then, within a matter of hours, the funds get transferred through a tree of companies. At the end of the day, it becomes really difficult for a forensic auditor to reach to the source.

At other times, back-to-back entries signal accommodation entries for two clients at the same time. Client A has cash and wants to convert black money into white. Client B has bank balance but wants black money. The shell company acts as an intermediary. Client B gives loan to the shell company from its bank balance by RTGS. The shell company gives loan of same value to Client A by RTGS. Client A gives cash of same amount to entry operator. The entry operator gives the cash to Client B. This way, client A gets white capital and client B gets black money for making kickback payments. The entry operator earns a commission of 0.25% to 0.75% of transaction value from both clients.

The writer has recently authored a book, ‘Tangible Guide to Intangibles: Identification, Valuation, Taxation & Transfer Pricing’. Views are personal