-

2016-09-27

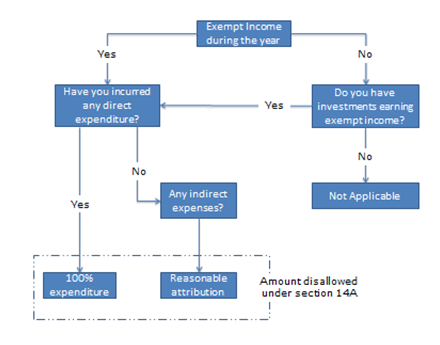

Under section 14A, expenditure incurred in relation to an income which does not form part of total income is not allowed as deduction. Section 10 deals with the incomes which do not form part of total income. Clause 21h of Form 3CD requires the tax auditor to certify the disallowance under section 14A.

An assessee, other than his business / profession income may also have agricultural income, share of profit from partnership firm, dividend income, long term capital gain from transfer of equity shares, interest from tax free bonds, etc. which do not form part of total income (referred to as ‘exempt income’). The assessee may also have assets / interests that may result in exempt income not in a current year but in a future year. From a tax audit standpoint, it becomes important for the tax auditor to determine: (a) whether the provisions of section 14A are attracted for the taxpayer and report the same in his tax audit report; (b) where it is determined that section 14A is applicable, what is the quantum of disallowance.

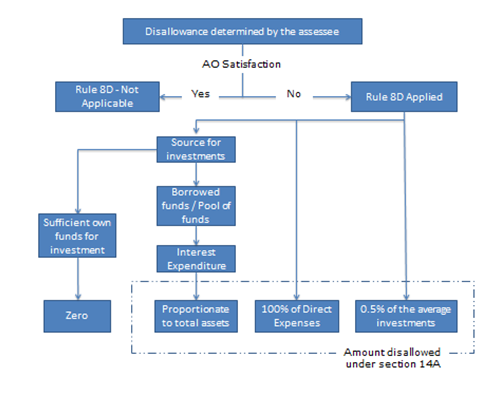

Where the assessee has derived exempt income and believes that he has in fact incurred expenditure for the same, a disallowance should be made with reference to direct expenses incurred and established principles of allocation of expenditure based on logical parameters like proportion of exempt income, time spent, turnover, quantum of investments, period of holding, rate of interest, sources of funds, etc. The tax auditor may also refer to SA 540 – Audit of Accounting Estimates. At the time of tax audit, the tax auditor will have to verify the amount of inadmissible expenditure as determined by the assessee.

In this context, it can be noted that the assessee / tax auditor can take the aid of Rule 8D of the Income-tax Rules, 1962 (‘the Rules’) to compute the disallowance, although he may not be bound by it. This is because, Rule 8D, as explicitly provided in section 14A, is a method that should be adopted by the tax officer to determine the disallowance (subject to satisfaction of certain conditions); the assessee is not obliged to use the same.

The tax auditor would be confronted with a scenario where the assessee has investments, income from which is tax-free, but has not received any exempt income and the assessee has not incurred any expenses. Here, the assessee can note that section 14A contemplates (as held by case law) a disallowance only when there is an exempt income. In the absence of exempt income, no disallowance can be made (Cheminvest Ltd. vs CIT [TS-5471-HC-2015(Delhi)-O]. A variant of this scenario is where the exempt income itself is offered to tax. A similar position can be adopted in light of first principles (Sansera Engineering Private Limited [TS-6410-ITAT-2015(Bangalore)-O].

There could also be a scenario where the assessee has incurred expenses but no exempt income. While a view can be taken that earning / accrual of exempt income is a sine qua non for invoking section 14A, this view would not be free from litigation.

Nexus of borrowed funds and investments.

Once there is exempt income, the next step for a tax auditor is to identify if there are any expenses that are indirectly related to the earning of the said income. Here, it is relevant to identify if there is a nexus between the borrowed funds and investments. There could be 4 scenarios:

1. An assessee has sufficient interest free funds in the form of reserves and surplus for the investments.

2. An assessee has sufficient interest free funds in the form of reserves and surplus for the investments, however, has also borrowed funds for capital expenses, working capital, etc.

3. Investments are made through a common pool of borrowed and own funds.

4. Direct nexus, investment made out of borrowed funds.

In cases referred to 1 and 2 above, where assessee has sufficient own funds and borrowed funds are not utilised for the purpose of investments, it is a valid presumption to proceed with that no expenditure (in the form of interest) is incurred for the purpose of earning exempt income. Application of Section 14A fails. This view has got support from a plethora of decisions like CIT vs Suzlon Energy Ltd [TS-5301-HC-2013(GUJARAT)-O], Yatish Trading Co (P) Ltd. vs Assistant CIT [TS-5846-ITAT-2010(MUMBAI)-O], CIT vs K Raheja Corpn. (P) Ltd. [TS-5833-HC-2011(Bombay)-O], Maruti Udyog Ltd. vs Dy CIT [TS-5610-ITAT-2004(DELHI)-O] of which one of the landmark ruling is of Hon’ble Punjab and Haryana High Court in the case of CIT v. Winsome Textile Industries Ltd [TS-5697-HC-2009(PUNJAB AND HARYANA)-O]. However, books of accounts maintained by the assessee should be able to evidence the investments made out of owned and interest free funds. Where the tax officer does not agree to such an approach, onus has been cast on the AO to establish a nexus between interest bearing funds and the investment made (Karnataka HC in CIT v. KSIIDLC [TS-5557-HC-2015(KARNATAKA)-O]). In this context it is important to analyse assessee’s fund flow and sources of funds for investment to prove that own funds were sufficient and actually have been utilised for the purpose of the investment.

In cases referred to scenario 3 or a case where the nexus of using own interest free funds for investment cannot be established, an appropriate proportion of the interest expenses have to be determined. If a rational allocation is not possible, Rule 8D(2)(ii) may be of help. In cases referred to scenario 4, the entire interest expenditure on borrowed funds shall be disallowed.

Strategic Investments.

In case of strategic investments made considering the business expediency to acquire controlling interest, the investments are made with no intention to earn exempt income. Recently, Hon’ble Karnataka High Court in the case of United Breweries Ltd. v. DCIT, Central Circle-2(3) [TS-5697-HC-2016(Karnataka)-O] laid down that disallowance under section 14A is applicable even if the investments are made to acquire controlling interest; but, also mentioned that the disallowance can be made only when interest bearing funds are utilised for investments.

Use of methodology prescribed under Rule 8D.

If the Assessing Officer (AO) is not satisfied with the correctness of the claim of expenditure or with the claim made by the assessee that no expenditure has been incurred in relation to the exempt income under section 14A, the AO shall apply Rule 8D to determine such disallowance. As such, while the Rule is to enable the AO to determine the quantum of expenditure, the assessee can also use the same.

Rule 8D(2) provides for 3 levels of determination of expenditure inadmissible viz. direct expenses, proportionate interest expense and an adhoc 0.5% of the average value of investments held during the year. The disallowance will be the aggregate of the 3 amounts determined.

Under Rule 8D(2)(i), any direct expenses incurred during the year is considered. These could be in the nature of interest on loan borrowed for investments, incidental expenses, demat account charges, brokerage, etc.

Under Rule 8D(2)(ii), if interest expenditure is incurred and not specifically identifiable as utilised towards making investments, then, the amount of disallowance is calculated as a proportion of average investments held against the average total assets of the assessee. And, Rule 8D(2)(iii) provides for 0.5% of the average investments held during the year as disallowance.

A number of issues arise in this prescribed method of calculating the average investments:

i) Whether investments from which exempt incomes are not earned / receivable should be considered for computing average investments.

The investments made by an assessee may include a mix of various investments viz. investments which earn dividend income, growth funds, dividend reinvestment plans, fixed maturity plan, etc. Section 14A is inserted with an intention to disallow the expenses incurred towards earning exempt income and to prevent double benefit to a tax payer in terms of income exemption and expenditure allowance. In such cases, for the purpose of calculating ‘Average Investments’ in order to compute disallowance under Rule 8D(2)(ii) and (iii), only investments from which exempt incomes are earned should be considered. Investments from which incomes are taxable cannot be considered. Examples of such investments and income are dividend from foreign company, interest on bonds, interest on fixed deposits, growth funds being debt funds, etc. This view is supported by the Hon’ble Delhi High Court in the case of ACB India Ltd. vs ACIT [TS-5217-HC-2015(Delhi)-O]

In the dividend re-investment plans for mutual funds, the dividend which is declared by the mutual fund house is re-invested in the mutual fund units. The dividend which is declared is exempt under section 10(35) and correspondingly the dividend amount is taken as the cost of the new units purchased out of the dividends. The investment is includible in the average investment calculation.

In case of equity oriented mutual funds, under section 10(38), Long term capital gains would be exempt. One of the possible views could be that the investment not be considered until held as short term. Alternate view could be to, not include the investment while calculating the average investment until the year of sale of investment.

ii) Whether interest expenditure incurred for earning taxable income should be reduced from the total interest income for the purpose of calculating proportionate interest for disallowance

Interest expenditure which could not be segregated between exempt income and taxable income is apportioned as per Rule 8D(2)(ii). Interest expenditure directly related to earn taxable income should be reduced from the total interest expenditure for the purpose of calculation of disallowance as per Rule 8D(2)(i) and (ii). Such an approach is upheld in Pr. CIT, Delhi-2 vs Bharti Overseas (P.) Ltd [TS-5587-HC-2015(DELHI)-O]. Few other judicial precedents have confirmed this view (Asstt. CIT vs Champion Commercial Co. Ltd [TS-6669-ITAT-2012(KOLKATA)-O], UFO Movies India Ltd. vs Assistant Commissioner of Income-tax, Circle-18 (1), New Delhi [TS-5199-ITAT-2016(DELHI)-O], Dhampur Sugar Mills Ltd. v. Commissioner of Income-tax, Bareilly [TS-5764-HC-2014(ALLAHABAD)-O]).

iii) Calculating disallowance in case of share of profit from a Partnership firm.

Partnership firm is a separate taxable entity for income tax purposes. Income charged in the hands of partnership firm cannot be treated as a taxable income in the hands of partner of such firm and, therefore, provisions of section 14A is applicable in computing the total income of such partner in respect of his share in the profits of the firm.

Say a partner is in receipt of salary and interest which would be assessable in the hands of the partner under section 28(iv) and interest paid by the partner on borrowed capital invested in the firm could be claimed as a deduction. In such a case if any disallowance is warranted, then the expenditure should be apportioned in the ratio between income from share of profit and salary/interest/remuneration.

While calculating the disallowance under rule 8D the Capital account balance as at the start and the end of the year could be considered. Alternate view is that even Current account balance should be included in the total investments.

Section 14A has been a litigation magnet since its inception because of the lack of clarity in the application and lack of guidance. Please note, as a tax auditor, facts and circumstances of each case play a vital role while applying section 14A principles.

A tax auditor may opine on the quantification keeping the above principles in mind while verifying the inadmissible expenditure under section 14A. The tax auditor may report his agreement / disagreement with the disallowance with suitable disclosures of material assumptions.