-

For support, write to us on: admin@taxsutra.com

- Register

- Login

Latest News

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

******

New Delhi, 15th February, 2023

PRESS RELEASE

CBDT notifies Income Tax Return Forms for the Assessment Year 2023-24 well in advance

CBDT has notified Income-tax Return Forms (ITR Forms) for the Assessment Year 2023-24 vide Notifications No. 04 & 05 of 2023 dated 10.02.2023 and 14.02.2023. These ITR forms will come into effect from 1st April, 2023 and have been notified well in advance in order to enable filing of returns from the beginning of the ensuing Assessment Year.

In order to facilitate the taxpayers and to improve ease of filing, no significant changes have been made to the ITR Forms in comparison to last year’s ITR Forms. Only the bare minimum changes necessitated due to amendments in the Income-tax Act, 1961 (the ‘Act’) have been made.

ITR Form 1 (Sahaj) and ITR Form 4 (Sugam) are simpler Forms that cater to a large number of small and medium taxpayers. Sahaj can be filed by a resident individual having income upto Rs. 50 lakh and who receives income from salary, one house property, other sources (interest etc.) and agricultural income upto Rs. 5 thousand. Sugam can be filed by individuals, Hindu Undivided Families (HUFs) and firms (other than Limited Liability Partnerships (LLPs)) being a resident having total income upto Rs. 50 lakh and income from business and profession computed under sections 44AD, 44ADA or 44AE.

Individuals and HUFs not having income from business or profession (and not eligible for filing Sahaj) can file ITR Form 2 while those having income from business or profession can file ITR Form 3. Persons other than individuals, HUFs and companies i.e. partnership firms, LLPs etc. can file ITR Form 5. Companies other than companies claiming exemption under section 11 can file ITR Form 6. Trusts, political parties, charitable institutions, etc. claiming exempt income under the Act can file ITR Form 7.

In order to further streamline the ITR filing process, not only have all the ITR forms been notified well in time this year, no changes have been made in the manner of filing of ITR Forms as compared to last year. The notified ITR Forms will be available on the Department’s website at www.incometaxindia.gov.in

(Surabhi Ahluwalia)

Pr. Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT.

Ministry of Finance

Demonetisation, inter alia, led to detection of black money, increase in tax collection and widening of tax base: Union MoS for Finance Shri Pankaj Chaudhary

Dated: 13 FEB 2023

Demonetisation, inter alia, led to detection of black money, increase in tax collection and widening of tax base. This was stated by Union Minister of State for Finance Shri Pankaj Chaudhary in a written reply to a question in Lok Sabha today.

Giving more information, the Minister stated that the outcome is indicated below:

1) During the period November 2016 to March 2017, the Income-tax Department conducted search and seizure actions in 900 groups leading to seizure of ₹900 crore, including cash of ₹636 crore and admission of undisclosed income of about ₹7,961 crore.

2) Growth rate of 18% for F.Y. 2017-18 in net direct tax collections over F.Y. 2016-17, which was highest in the preceding seven financial years, indicated the positive impact of demonetisation on the level of tax compliance in the country.

3) In F.Y. 2017-18, Personal Income-tax (PIT) Advance Tax collections increased by 23.4% and PIT Self-Assessment Tax by 29.2% over those for F.Y. 2016-17, corroborating the premise that demonetisation and the subsequent use of bank deposit data by the Income-tax Department had a major impact on voluntary tax payments by the non-corporate / individual taxpayers.

4) A growth rate of 25% was achieved in the number of Income Tax Returns (ITRs) filed with the Income-tax Department during F.Y. 2017-18. It was the highest rate achieved in the preceding five years.

5) During F.Y. 2017-18, the number of new ITR filers was about 1 crore 7 lakh as compared to 85.51 lakh during F.Y. 2016-17. In earlier years, the number of new filers was between 50 lakh and 66 lakh. There is, therefore, a clear upswing in the new tax filers during the F.Y. 2016-17 and F.Y. 2017-18, which can be attributed to higher level of compliance due to transfer of cash into the formal channels as a result of demonetisation.

6) A growth rate of 17.2% was achieved in the number of returns filed by corporate taxpayers during F.Y. 2017-18. It was more than 5 times the growth rate of 3% in F.Y. 2016-17 and 3.5% in F.Y. 2015-16.

Further, the Minister stated, demonetisation has helped the Government to unearth the unaccounted money, held by the offenders, which got disclosed during investigation of cases by the Directorate of Enforcement (ED) under Prevention of Money Laundering Act (PMLA), 2002 and Foreign Exchange Management Act (FEMA), 1999.

Under PMLA, investigations have been taken up in 08 cases wherein 107 persons were found involved in any process of generation, acquisition and/or projection of unaccounted money. In these cases, proceeds of crime amounting to ₹191.68 crore have been attached / seized and 05 accused have been arrested. Further, 13 Prosecution Complaints (PCs) including 07 Supplementary PCs have been filed in these cases. Similarly, investigations in 10 cases against 19 persons have been initiated under provisions of FEMA wherein currency amounting to ₹2.99 crore have been seized. Further, 08 Show Cause Notices have been issued, out of which 05 have been adjudicated. During adjudication, penalty amounting to ₹1.61 crore were imposed. Further, seized currency amounting to ₹77.81 lakh has also been ordered to be confiscated during adjudication.

Ministry of Finance

Seizure of black money

Dated: 13 FEB 2023

The word ‘black money’ is not defined under the Income Tax Act, 1961, Customs Act, 1962, CGST Act, 2017, Central Excise Act, 1944 and erstwhile Chapter V of Finance Act, 2017 (related to Service Tax). This was stated by Union Minister of State for Finance Shri Pankaj Chaudhary in a written reply to a question in Lok Sabha today.

As far as Income Tax Department (ITD) is concerned, the Minister stated, whenever any credible information of ‘direct-tax’ evasion comes to its notice, it takes suitable action(s), including the search & seizure operations, to bring to tax, undisclosed income. The details of assets seized during the search & seizure operations is provided in the ANNEXURE.

Further, the details of cash seizures made by the field formations of Central Board of Indirect Taxes & Customs (CBIC), including Directorate of Revenue Intelligence (DRI), are provided in the ANNEXURE.

The details of actions taken by ED are included in ANNEXURE.

Giving out more information, the Minister stated that the Government enacted a comprehensive and a stringent new law, namely, the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BMA, 2015) that has come into force w.e.f. 01.07.2015. The offence of willful attempt to evade tax, etc. in relation to undisclosed foreign income/assets is a Scheduled Offence under the Prevention of Money Laundering Act, 2002 (PMLA), regarding which suitable action is taken by Directorate of Enforcement (ED) for identification of proceeds of crime generated, provisional attachments and filing of prosecution complaints in suitable cases.

The details of actions taken by ITD under BMA, 2015 are as under:

i) 648 disclosures involving undisclosed foreign assets worth Rs. 4,164 crore were made in the one-time three months compliance window, under BMA, 2015, which closed on 30th September 2015. The amount collected by way of tax and penalty in such cases was about Rs. 2,476 crore.

ii) As on 30.11.2022, assessments under BMA, 2015 have been completed in 394 cases, raising tax demand of over Rs. 15,570 crore. Further, 125 prosecution complaints have been filed under the provisions of BMA, 2015. The State/UT-Wise details are not maintained separately.

The details of actions taken by ED in relation to cases involving violations related to BMA, 2015 are as under:

i) During investigation in 13 PMLA cases in relation to predicate offences involving violations related to BMA, 2015, proceeds of crime amounting to Rs. 42.57 crore has been attached/seized and 03 Prosecution complaints have been filed.

ii) Further, assets amounting to Rs. 93.07 crore has been seized under section 37A of FEMA in 05 cases.

The Minister stated that the Government of India has entered into Double Taxation Avoidance Agreements /Tax Information Exchange Agreements /Multilateral Convention on Mutual Administrative Assistance in Tax Matters/SAARC Multilateral Agreement (“tax treaties”) with other countries which provide for exchange of information, which is foreseeably relevant for administration and enforcement of domestic laws concerning taxes. India has been proactively engaging with foreign governments, for exchange of information under these tax treaties.

The Minister further stated that FIU-India is a member of the Egmont Group, an international organisation for exchange of information and Co-operation amongst Financial Intelligence Units (FIUs). The group comprises 167 members as on date. As members to the Egmont Group, FIUs can exchange freely information on real time basis through a highly secured network - Egmont Secured Web (ESW) - on various matters as per their roles and functions. FIU-India has also entered into Memoranda of understanding (MoUs) with 48 countries to strengthen bilateral relationships with its foreign counterparts since 2008 upto 2022 for exchange of intelligence.

Giving more information, the Minister stated that there is no official estimation or methodology to define/measure the amount of black money in the country. However, the Government had commissioned a study, inter alia, on estimation of unaccounted income and wealth inside and outside the country, through National Institute of Public Finance and Policy (NIPFP), National Council of Applied Economic Research (NCAER) and National Institute of Financial Management (NIFM). The reports and a detailed Government’s response on them were forwarded to the Lok Sabha Secretariat for placing them before the Standing Committee on Finance. The Standing Committee on Finance, after due deliberations and taking necessary oral evidences, presented a preliminary report on the matter (i.e. 73rd Report of Standing Committee on Finance) to Speaker of Lok Sabha on 28.03.2019 and this report has observed that “the unaccounted income and wealth inside and outside the country do not appear amenable to credible estimation in the context of India.”

Click here to read and download F. No. 189/3/2022-ITA-I

Ministry of Finance

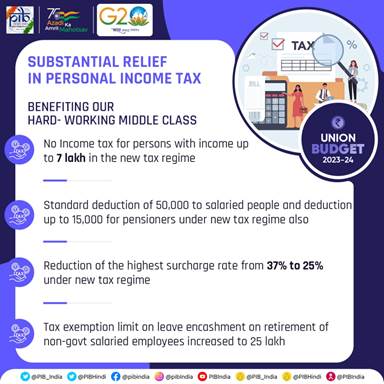

MAJOR ANNOUNCEMENTS IN PERSONAL INCOME TAX TO SUBSTANTIALLY BENEFIT THE MIDDLE CLASS

PERSONS WITH INCOME UP TO RS. 7 LAKH WILL NOT PAY INCOME TAX IN NEW TAX REGIME

TAX EXEMPTION LIMIT INCREASED TO RS. 3 LAKH

CHANGE IN TAX STRUCTURE: NUMBER OF SLABS REDUCED TO FIVE

SALARIED CLASS AND PENSIONERS TO GAIN ON EXTENSION OF STANDARD DEDUCTION BENEFIT TO THE NEW TAX REGIME

MAXIMUM TAX RATE REDUCED TO 39 PER CENT FROM 42.74 PER CENT

NEW TAX REGIME TO BE THE DEFAULT TAX REGIME

CITIZENS TO HAVE THE OPTION TO AVAIL THE BENEFIT OF OLD TAX REGIME

Dated: 01 FEB 2023

With the objective of benefitting the hard working middle class of the country, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitaraman made five major announcements with respect to personal income tax while presenting the Union Budget 2023-24 in Parliament today. These announcements pertaining to rebate, change in tax structure, extension of benefit of standard deduction to the new tax regime, reduction of highest surcharge rate and extension of limit of tax exemption on leave encashment on retirement of non-government salaried employees will provide substantial benefits to the working middle class.

In her first announcement regarding rebate, she proposed to increase the rebate limit to Rs.7 lakh in the new tax regime, which would mean that the persons in the new tax regime, with income up to Rs. 7 lakh will not have to pay any tax. Currently, those with income up to Rs. 5 lakh do not pay any income tax in both old and new tax regimes.

Providing relief to middle-class individuals, she proposed a change in the tax structure in the new personal income tax regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs. 3 lakh. The new tax rates are:

|

Total income (Rs.) |

Rate (per cent) |

|

Upto 0-3 lakh |

Nil |

|

From 3-6 lakh |

5 |

|

From 6-9 lakh |

10 |

|

From 9-12 lakh |

15 |

|

From 12-15 lakh |

20 |

|

Above 15 lakh |

30 |

This will provide major relief to all tax payers in the new regime. An individual with an annual income of Rs. 9 lakh will be required to pay only Rs. 45,000/-. This is only 5 per cent of his or her income. It is a reduction of 25 per cent on what he or she is required to pay now, i.e. Rs. 60,000/-. Similarly, an individual with an income of Rs. 15 lakh would be required to pay only Rs. 1.5 lakh or 10 per cent of his or her income, a reduction of 20 per cent from the existing liability of Rs. 1,87,500/.

The third proposal of the budget provides major relief to the salaried class and the pensioners including family pensioners as the Finance Minister proposed to extend the benefit of standard deduction to the new tax regime. Each salaried person with an income of Rs. 15.5 lakh or more will thus stand to benefit by Rs. 52,500/-. At present, standard deduction of Rs. 50,000/- to salaried individuals and deduction from family pension up to Rs. 15,000/- is currently allowed only under the old regime.

As part of her fourth announcement with respect to personal income tax, Smt. Nirmala Sitaraman proposed to reduce the highest surcharge rate from 37 per cent to 25 per cent in the new tax regime for income above Rs. 2 crore. This would result in reduction of the maximum tax rate to 39 per cent from the present 42.74 per cent, which is among the highest in the world. However, no change in surcharge is proposed for those who opt to be under the old regime in this income group.

As part of the fifth announcement, the budget proposed extension of limit of tax exemption on leave encashment to Rs. 25 lakh on retirement of non-government salaried employees in line with the government salaried class. At present, the maximum amount which can be exempted is Rs. 3 lakh.

The budget proposed to make the new income tax regime as the default tax regime. However, citizens will continue to have the option to avail the benefit of the old tax regime.

******

RM/PPG/RC

(Release ID: 1895286)